Houthi assaults on vessels in the Gulf of Aden and the Red Sea have led to a reduction in maritime traffic transiting through Bab al-Mandab towards the Mediterranean Sea and vice versa. Concurrently, there has been a rise in the utilization of the Djibouti port of Doraleh, suggesting potential advantages for Djibouti ports stemming from these hostilities. This is evidenced by the heightened provision of logistical services to vessels traversing the area and the expanding significance of Djiboutian ports in facilitating the transportation of goods into the African hinterland, alongside increased re-exportation activities. This trend contrasts with the decline experienced by some other ports along the Red Sea, attributed to ships’ avoidance of areas under threat by the Houthis.

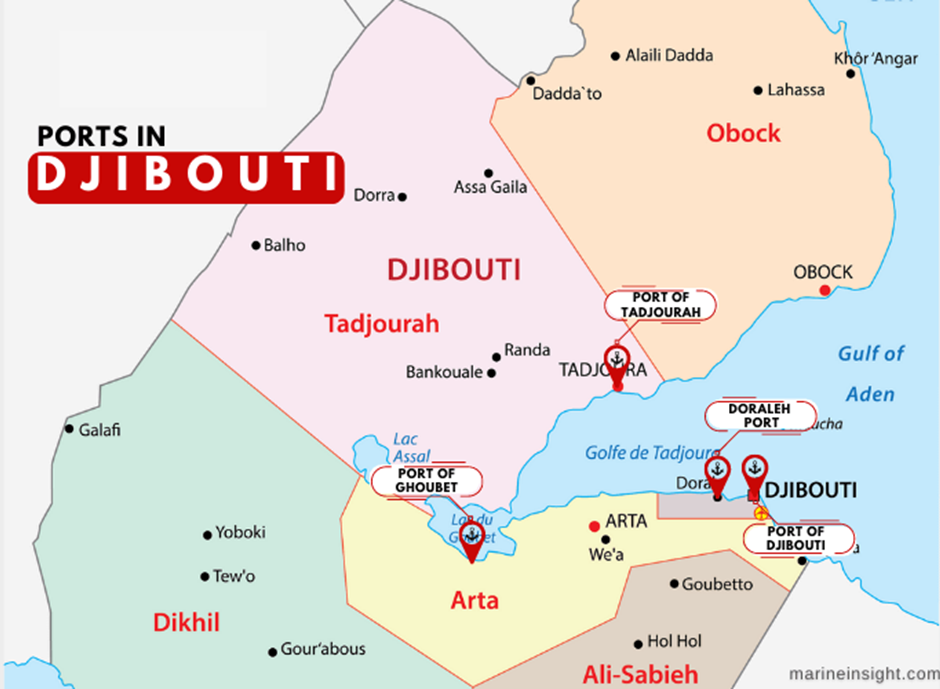

In spite of the setbacks experienced by maritime transportation and global commerce in the present year, particularly following assaults by the Houthi militia on vessels traversing the Red Sea and the Gulf of Aden, impacting the so-called “port economies,” Djibouti ports managed to capitalize on this crisis, transforming it into advantageous prospects. Ismail Hassan, advisor to the CEO of Operations Affairs at the Port of Doraleh, affirmed on February 26, 2024, that the port observed a rise in container throughput in January 2024, ranging from 5% to 10% compared to preceding months, handling over 100,000 containers during that month. All global maritime transportation firms operate at Doraleh Port, which facilitates connections with over 60 worldwide ports and accommodates the largest vessels. Djibouti features four primary specialized ports, catering to container operations, as well as imports and exports of various commodities like livestock and energy resources.

Increasing importance

Despite the adverse effects experienced by numerous ports along the Red Sea and the Gulf of Aden resulting from Houthi attacks on vessels, the significance of Djibouti ports has notably escalated. This upsurge can be ascribed to several plausible factors, as outlined below.

1- Enhancing the provision of logistical services for transient vessels: The challenges faced by vessels navigating the Red Sea, fearing attacks by the Houthis while traversing the Bab al-Mandab Strait, have led to an increased reliance on Djibouti ports by certain ships. Djibouti serves as a crucial hub for trade convoys moving from south to north, providing essential access to logistics and maintenance services. Incidents of Houthi attacks damaging ships have further emphasized the importance of Djibouti ports as a safe haven for repairs and continued voyages. Notably, Marine Colonel Wais Omar Baqri, Commander of the Djibouti Coast Guard, highlighted in February 2024 that damaged ships seek refuge in Djibouti for repairs before resuming their journeys, underscoring the growing significance of Djibouti ports in the strategic maritime landscape of the region.

Contrary to the aforementioned, numerous sources have reported that certain vessels were stationed in the territorial waters and ports of Djibouti to evade and counteract the Houthi assaults. Subsequently, a determination was made regarding whether to proceed along their original course through the Red Sea or divert towards the Cape of Good Hope route, reflecting the perspective of international maritime corporations. Despite ongoing military conflicts in the vicinity, Djibouti’s territorial waters are recognized as a secure zone. This element of safety is deemed crucial for the present utilization and prospective reliance on Djibouti’s ports in potential future instances of similar hostilities.

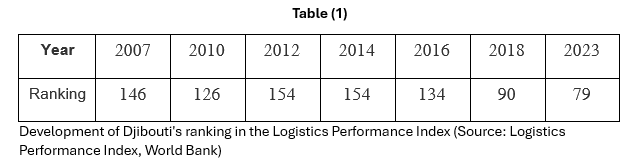

The consistent advancement of Djibouti’s logistics performance indicators in recent years underscores its proficiency in maritime operations and cargo management. Djibouti’s standing in the World Bank’s Logistics Performance Index climbed from 146th in 2007 to 79th in the 2023 index

Some sources have indicated that ships altering their sailing route to the Cape of Good Hope encounter issues with the inadequate preparedness of African ports along that route. This results in difficulties in accessing fuel refueling and logistical services. Consequently, Djibouti ports may emerge as a significant provider of these services, whether through the conventional Red Sea/Suez Canal passage or the Cape of Good Hope route, owing to its strategic position at the convergence of various international shipping routes.

2- An increasing role for transporting goods into Africa: Djibouti ports serve as pivotal hubs for facilitating the transportation of goods to and from landlocked nations in Africa, specifically Ethiopia and South Sudan. Moreover, the apprehension surrounding maritime passage via the Red Sea presents a prospect to utilize Djibouti ports for land-based transit of merchandise to adjacent countries such as Eritrea. This alternative route becomes particularly significant in the context of ongoing internal turmoil in Sudan, which has disrupted maritime trade flows, offering a conduit for trade to penetrate the Sudanese hinterland while bypassing conflict zones. Reference is made to the reopening of the Al-Laffa border crossing connecting Sudan to Eritrea in September 2023, aiming to enhance trade flow between the two nations. This development suggests that the ongoing regional integration efforts in East Africa could potentially bolster the significance of Djibouti’s ports, particularly with their expanding capacities, enabling the handling of large vessels that surpass the capabilities of other ports in the area.

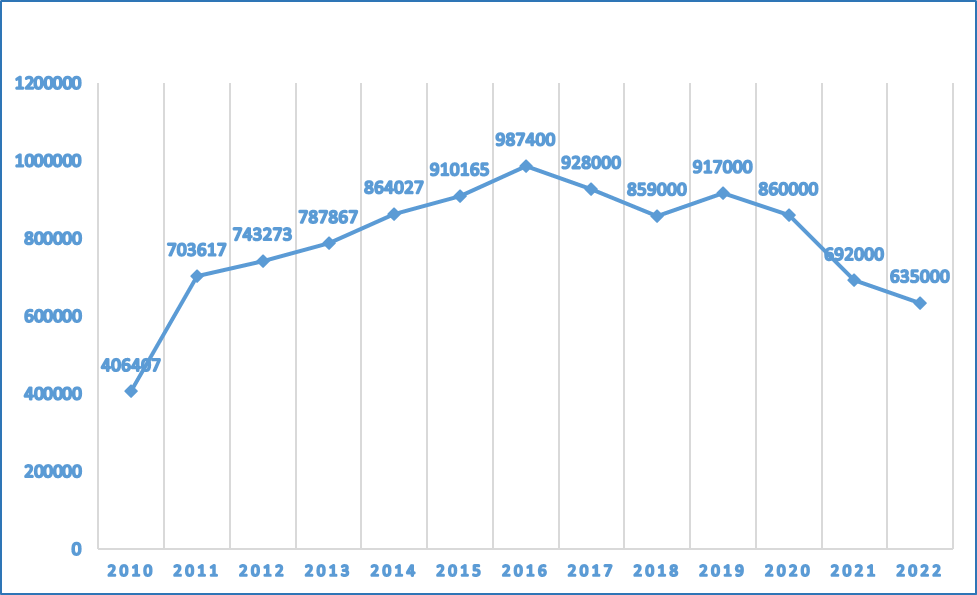

The trend is exemplified by the growth in container handling capacity at Djibouti ports, which has shown a consistent increase over recent years. The capacity rose from approximately 406 thousand TEU in 2010 to around 917 thousand TEU in 2019, marking a 126% increase. However, the volume of container handling experienced a decline post-pandemic, with a reduction to about 635 TEU in 2022. (TEU represents the twenty-foot equivalent unit utilized for quantifying the volume of goods transported in containers, be it on vessels or trucks.)

(Source: Container port throughput, UNCTAD)

3- Increased re-export activity: The decrease in maritime traffic passing through the Red Sea led to a decline in re-export operations at the adjacent ports. However, Ismail Hassan, advisor to the CEO of Operations Affairs at Doraleh Port, noted an increase in container handling in January compared to preceding months. This trend suggests a growing inclination among certain shipping companies to utilize the ports of Djibouti, establishing it as a significant hub for such operations amidst prevailing tensions.

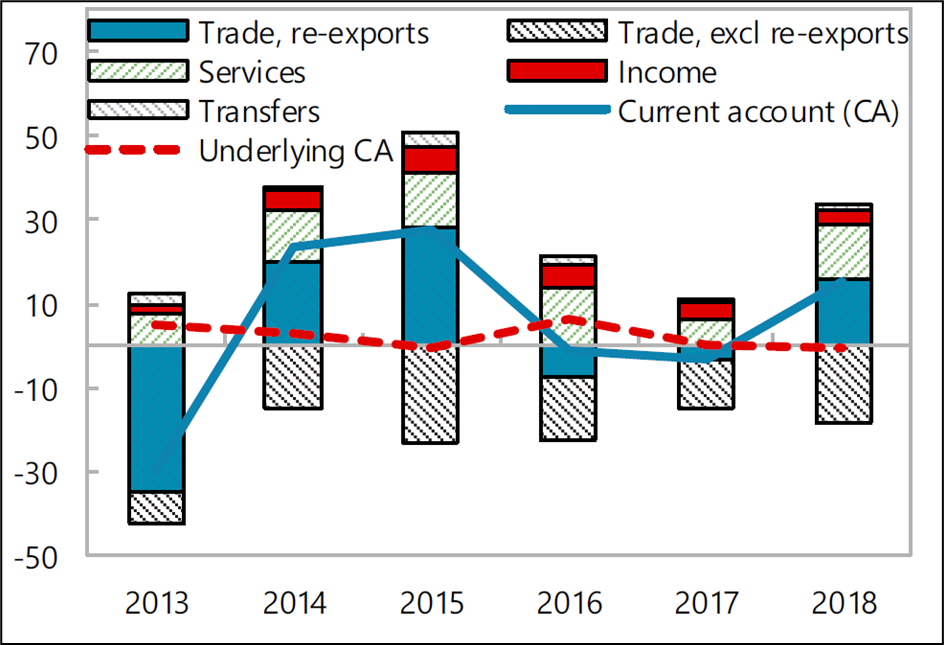

Djibouti’s economy is heavily reliant on transportation and logistics services, with the services sector contributing approximately 80% to the country’s gross domestic product (GDP). In contrast, the industrial and agricultural sectors contribute 17% and 3% to the GDP, respectively, based on data from the Union. Furthermore, Djibouti’s foreign trade is predominantly driven by re-export activities facilitated by the robust logistics infrastructure in Djibouti’s ports. The country also depends on the export of maritime transport services, which are crucial for maintaining a favorable balance of payments and current account. These activities underscore the significant role of Djibouti in global trade, with implications for the Ethiopian economy as a decline in these sectors correlates with a downturn in national economic indicators.

During the period (2013-2018) (as a percentage of GDP) (Source: 2019 Article IV Consultation Press Release; Staff Report; and Statement by the Executive Director for Djibouti, International Monetary Fund)

The preceding figure illustrates that re-export operations significantly bolstered the role of foreign trade in the current account during the years 2014, 2015, and 2018. This trend aligns with the enhanced capacity of Djiboutian ports for ship reception and container handling, as indicated by the rise in services exports contributing to the current account during the same period. It is anticipated that re-export activities and exports of maritime transport services will progressively constitute a larger proportion of Djibouti’s total exports in the present period due to the escalating reliance on Djibouti’s ports. Consequently, the persistent trade deficit faced by Djibouti is expected to diminish, which surged from approximately $4.1 billion in 2015 to $10.4 billion in 2022, marking a 153% increase (as per the Trade Map website specializing in international trade data).

A Pivotal Role In The Future

The heightened utilization of Djibouti ports subsequent to escalated Houthi threats post the Israeli conflict in Gaza highlights their significance in bolstering maritime transit in the Red Sea moving forward. These ports are poised to offer enhanced efficacy during crises compared to counterparts in the region, given their strategic positioning along key global shipping routes, facilitating vital logistical support for vessels to successfully conclude their voyages. It could potentially emerge as a significant hub for re-exportation and a key entry point for trade originating from Asia to central Africa. Consequently, numerous nations may enhance their involvement in Djibouti’s maritime transport industry in the near future to capitalize on the anticipated growth of their ports in facilitating international trade. However, the principal ports in the Red Sea pose a significant obstacle for Djibouti to assume this role effectively.